How Do I Know Which Loan Program To Choose?

When you first begin the homebuying process, this question can be quite confusing. There’s truly no “best program”. In fact, the best answer is, “it depends.”

No two home buyers are alike, so it’s up to you and your loan adviser to choose the mortgage program that works best for you.

Today’s buyers are fortunate to have access to a wide variety of loan options. Here, we will discuss the 4 main loan programs which may help point you in the right direction. We recommend you reach out to one of our loan wizards here at Oz Lending who will be happy to answer your questions to help determine the program that is the best fit for you and your family.

While there are many other loan programs available such as Jumbo loans, adjustable-rate mortgage loans, etc., our goal here is to focus on the most frequently used loan programs. Your loan wizard will be able to guide you into another program if required by your situation.

How to start your mortgage search

Each home loan program has unique benefits that cater to a certain type of buyer. Your goal should be to find the one that matches your ‘wants’ and your ‘needs.’ Here are a few questions you should be asking yourself as you explore the different loan types:

- Which loan has the lowest monthly payment?

- What option requires the least amount upfront?

- What option will cost me less over time?

- Which loan type is suitable for my credit score?

- How does my income affect the products for which I’m eligible?

- What’s my price range for home buying?

- How long do I plan to stay in the home?

Your answers to these questions will help you evaluate the different types of mortgages below and think about which one(s) could be best for your situation.

Compare types of mortgage loans

Conventional mortgage

Conventional loans are the go-to choice for many home buyers today. They offer great rates, many down payment options, and flexible terms.

Many conventional loans are known as “conforming loans” because they conform to standards set by Fannie Mae and Freddie Mac.

What this means for you is that most lenders across the country offer these loans. Banks, credit unions, and mortgage companies in nearly every U.S. city are able to offer conforming mortgages at competitive rates.

Most mortgage lenders require a credit score of 620 or higher for a conventional/conforming loan.

And these mortgages come with a feature that many others don’t: Your mortgage rate is directly tied to your credit score and down payment. So, the stronger your finances are, the better deal you’ll get.

Conventional loan pros:

- Down payments as low as 3%

- No upfront mortgage insurance fees

- Available for all types of properties:

- Primary residence (the home you’ll live in)

- second homes

- vacation homes

- investment properties

- Fixed and adjustable rates available

- Loan terms from 10 to 30 years available

- Private mortgage insurance (PMI) can be canceled with 20% home equity

- Loan amounts up to $625,000 and more in high-cost counties

Conventional loan cons:

- Private mortgage insurance (PMI) required with less than 20% down

- Lower credit scores mean higher interest rates

- Smaller down payments mean higher interest rates

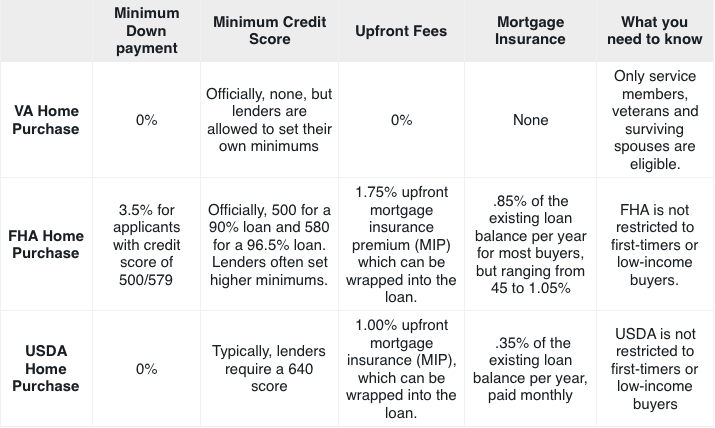

FHA home loans

FHA loans are the favorite for many of today’s first-time home buyers. Their popularity is understandable.

With small down payment requirements, ultra-lenient credit score standards, and flexible income guidelines, the FHA mortgage is making homeownership available to a wide swath of renters.

Thanks to their backing from the Federal Housing Administration, FHA loans can be lenient with credit and income guidelines and still offer low interest rates.

FHA loan pros:

- 3.5% down payment requirement

- Low credit score requirement: 580 with 3.5% down or 500 with 10% down

- Down payment gifts and/or down payment assistance can cover 100% of the down payment and closing costs

- Lenient income qualification

- Loan terms of 30 and 15 years available

- Fixed-rate and adjustable-rate mortgages available

- One- to four-unit homes are allowed; you can rent out additional units as long as you live in one

FHA loan cons:

- Upfront and monthly mortgage insurance premiums (MIP) are required regardless of down payment

- Mortgage insurance is not cancelable with 20% home equity

- FHA loan limits are lower than conforming loan limits: Currently $356,362 in most areas (but higher in expensive counties)

- The home must be a primary residence; no investment properties or vacation homes allowed

Home buyers with eligible military service history can qualify for a 100% (zero-down) loan backed by the U.S. Department of Veterans Affairs.

VA loans are often considered the best mortgages on the market, and for good reason: they offer lower rates than ‘standard’ loans, and there is never any monthly mortgage insurance required.

Buyers with any type of U.S. military service history — including veterans, active-duty service members, and surviving spouses — should consider this loan first.

VA loan pros:

- Very low mortgage rates

- Absolutely no down payment is required

- No mortgage insurance

- Very lenient about credit scores

- 15- and 30-year fixed-rate loans available

- Adjustable-rate mortgages available

- One- to four-unit homes are allowed; you can rent out additional units as long as you live in one

VA loan cons:

- Minimum service history required to qualify

- Upfront funding fee required, ranging from 1.4% to 3.6% of the loan amount (though this can be rolled into the mortgage instead of paying upfront)

- The home must be a primary residence

The U.S. Department of Agriculture backs a home loan program that goes by many names: the Rural Development (RD) loan, the Single-Family Housing Guaranteed program, or most commonly, the ‘USDA loan.’

The USDA loan targets low-income to moderate-income home buyers who plan to live in rural and suburban areas.

The program is meant to make homeownership more affordable by eliminating the down payment requirement. It also offers reduced interest rates and mortgage insurance costs.

USDA loan pros:

- No down payment required

- Low mortgage insurance fees

- Below-market mortgage rates

- Credit scores starting at 640 are eligible

- No loan limits

USDA loan cons:

- The home must be in a USDA-eligible ‘rural area’

- Borrowers must meet household income limits

- A fixed-rate, 30-year term is the only option

How to choose a home loan

The good news is, you’re not alone when it comes to choosing the right type of mortgage. Your Oz Lending loan wizard will provide expertise and guidance to help you make the best choice.