How Today’s Mortgage Rates Impact Your Home Purchase

If you’re planning to buy a home in the Dallas/Fort Worth area, it’s critical to understand the relationship between mortgage rates and your purchasing power. Purchasing power is the amount of home you can afford to buy that’s within your financial reach. Mortgage rates directly impact the monthly payment you’ll have on the home you purchase. So, when rates rise, so does the monthly payment you’re able to lock in on your home loan. In a rising-rate environment like we’re in today, that could limit your future purchasing power.

Oz Lending is a Dallas mortgage services company that specializes in home mortgage loans. Our loan advisors can help you understand how the current mortgage rates will impact your home purchase and help you get into the best type of loan for your family and budget.

Today, the average 30-year fixed mortgage rate is above 5%, and in the near term, experts say that’ll likely go up in the months ahead. You have the opportunity to get ahead of that increase if you buy now before that impacts your purchasing power.

Mortgage Rates Play a Large Role in Your Home Search

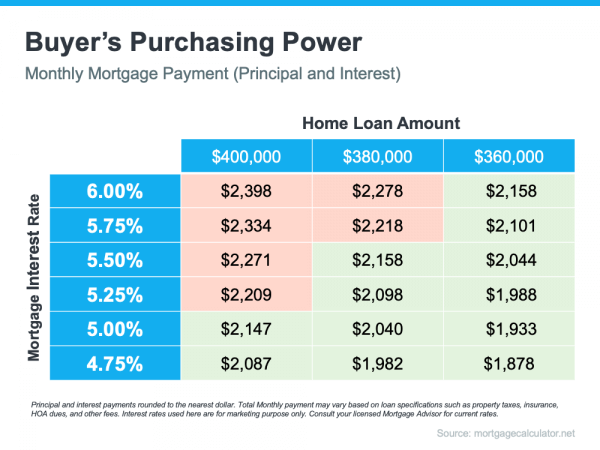

The chart below can help you understand the general relationship between mortgage rates and a typical monthly mortgage payment within a range of loan amounts. Let’s say your budget allows for a monthly mortgage payment in the $2,100-$2,200 range. The green in the chart indicates a payment within that range, while the red is a payment that exceeds it (see chart below):

As the chart shows, you’re more likely to exceed your target payment range as mortgage rates increase unless you pursue a lower home loan amount. If you’re ready and looking to buy a home in the Dallas Metroplex, use this as your motivation to purchase now so you can get ahead of rising rates before you have to make the decision to decrease what you borrow in order to stay comfortably within your budget.

Work with Oz Lending, A Trusted Mortgage Advisor, To Know Your Budget and Make a Plan

If you are buying a home in Dallas, Fort Worth, North Texas or anywhere in the US, it’s critical to keep your budget top of mind as you’re searching for a home. Danielle Hale, Chief Economist at realtor.com, puts it best, advising that buyers should:

“Get preapproved with where rates are today, but also consider what would happen if rates were to go up, say another quarter of a point, . . . Know what that would do to your monthly costs and how comfortable you are with that, so that if rates do move higher, you already know how you need to adjust in response.”

Get Pre-Approved Through Oz Lending

No matter what, the best strategy is to work with your real estate advisor and Oz Lending to create a plan that takes rising mortgage rates into consideration. Together, we will look at your budget based on where rates are today and craft a strategy so you’re ready to adjust as rates change.

Bottom Line

Even small increases in mortgage rates can impact your purchasing power. If you’re in the process of buying a home here in Dallas or anywhere in Texas, it’s more important than ever to have a strong plan. Connect with Oz Lending so you have a trusted lender on your side who can help you strategize to achieve your dream of homeownership this season.